Charitable Remainder Trusts Can Benefit You and Your Favorite Charity

If you are like many people who own appreciated stock or real estate, you may be concerned about capital gains tax upon the sale of your property. Or perhaps you recently sold appreciated property and are looking for a way to offset your current tax liability with a charitable deduction. If you are nearing your retirement years, you may be evaluating options for increasing your income in the future. For all these reasons, you might consider a charitable remainder trust (CRT).

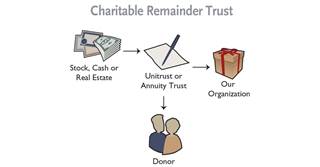

With a CRT, you transfer cash, appreciated assets, or other property to a special trust that is invested to generate income payments for you and any other beneficiaries you select. The terms of the trust cannot exceed 20 years, and at the end of the term, the named charity or charities will receive the remaining trust assets to use as designated by the donor.

There are several potential tax benefits of a CRT:

There are two types of charitable remainder trusts to choose from. Both the Charitable Remainder Annuity Trust (CRAT) and Charitable Remainder Unitrust (CRUT) require a minimum trust payout of 5 percent. However, the payout amounts provided to beneficiaries differ. A CRAT pays a fixed amount each year on the date the trust is funded. The CRUT payout amount varies from year to year and is based on the investment performance of the trust assets each year. If the trust grows in value over time, the amount of your payments will increase as well.

A CRT is a great way for you to provide benefits for both yourself and for a charity. The CRT can provide you with income, a tax deduction, and funds that your favorite charity or charities may use to accomplish their goals and mission. Please contact Chris Cole, managing director of gift planning at ccole@ducks.org or call 901-758-3763 to learn more and view a custom illustration of CRT benefits for you.

When selecting a trustee, you have several options:

If you have already added Ducks Unlimited to your estate plan, please contact us. We would be honored to present you with a lapel pin or pendant and enroll you as a member in the Feather Society, DUs most prestigious group of members.

Ducks Unlimited uses cookies to enhance your browsing experience, optimize site functionality, analyze traffic, and deliver personalized advertising through third parties. By continuing to use this site, you agree to our use of cookies. View Privacy Policy